Bitcoin’s September Dip: A Familiar Crash Before the Big Push

The Setup: Low Liquidity, Big Moves

Bitcoin is stumbling on a quiet, low-liquidity summer day — the kind of day where price swings feel exaggerated because there simply aren’t enough buyers and sellers to soak up the action. And it’s happening just weeks before the usual September slump, a pattern we’ve seen in almost every post-halving cycle.

The timing couldn’t be more interesting. The Federal Reserve has now officially moved away from its strict 2% inflation target, a shift that could free up liquidity and push capital further out the risk curve. In plain terms, it opens the door for more money to flow into assets like crypto. Meanwhile, Ethereum is finally stepping into Wall Street’s spotlight, with Fundstrat’s Tom Lee championing ETH as the chain that could one day flip Bitcoin in network value.

Add in political saber-rattling (with Trump making headlines about China), and you’ve got a cocktail of volatility. But here’s the thing: this could be the dip before the rip.

CRASH COMING? Survive September To GET RICH From Altcoins

The September Effect in Crypto

History is clear: September is rarely kind to Bitcoin.

-

In 2017, Bitcoin fell nearly 40% during September.

-

In 2021, we saw a 25% drop that flushed out weak hands.

Both times, the sell-offs were brutal. But both were followed by explosive rallies:

-

After the 2017 dip, Bitcoin ripped higher by 560%.

-

After the 2021 dip, it rallied 72% into year-end.

This isn’t just bad luck — it’s a recurring rhythm of the four-year cycle. With the halving coming earlier this year, the timeline has shifted forward. That suggests the September dip may simply be arriving a few weeks early.

Ethereum’s Turn on the Big Stage

While Bitcoin corrects, Ethereum may be stealing the narrative. Tom Lee has been making the case that what happened in 1971, when the dollar left the gold standard, is happening again — only this time, with markets moving on-chain.

Back then, decoupling the dollar from gold accelerated financial innovation. Today, Ethereum could play the same role: a base layer for faster, more transparent markets.

ETH ETFs have already attracted billions in inflows, a clear sign institutions are listening. Skeptics point to low on-chain usage, but that misses the point. Wall Street isn’t buying Ethereum for today’s transactions; they’re betting on its future role as the backbone of tokenized markets.

Where Does Bitcoin Go From Here?

Breaking below the $112K range spooked traders, but this isn’t new territory. We’ve seen similar deviations before — sharp drops followed by equally sharp recoveries. The bigger question is whether this dip marks the cycle’s local bottom or just another step toward a deeper correction.

Looking at historical patterns, a drop into the $100K zone wouldn’t be unusual. But whether it stops at 100K or dips into the low 90s, history also suggests that buying these moments has paid off handsomely for those with patience.

The Bigger Picture: 4-Year Cycle or Something New?

We’re at a crossroads. Are we still locked into the classic four-year cycle — sharp rallies followed by devastating crashes? Or are we transitioning into something that looks more like a traditional equity bull market, with institutions smoothing out volatility as they pile in?

The truth is, nobody knows. But here’s the hopeful case: if institutional flows continue, we may get a more gradual, extended bull market instead of another boom-and-bust. That would be healthier for crypto as an industry — attracting new participants without burning them out in the next crash.

Strategy: Survive September, Position for Alt Season

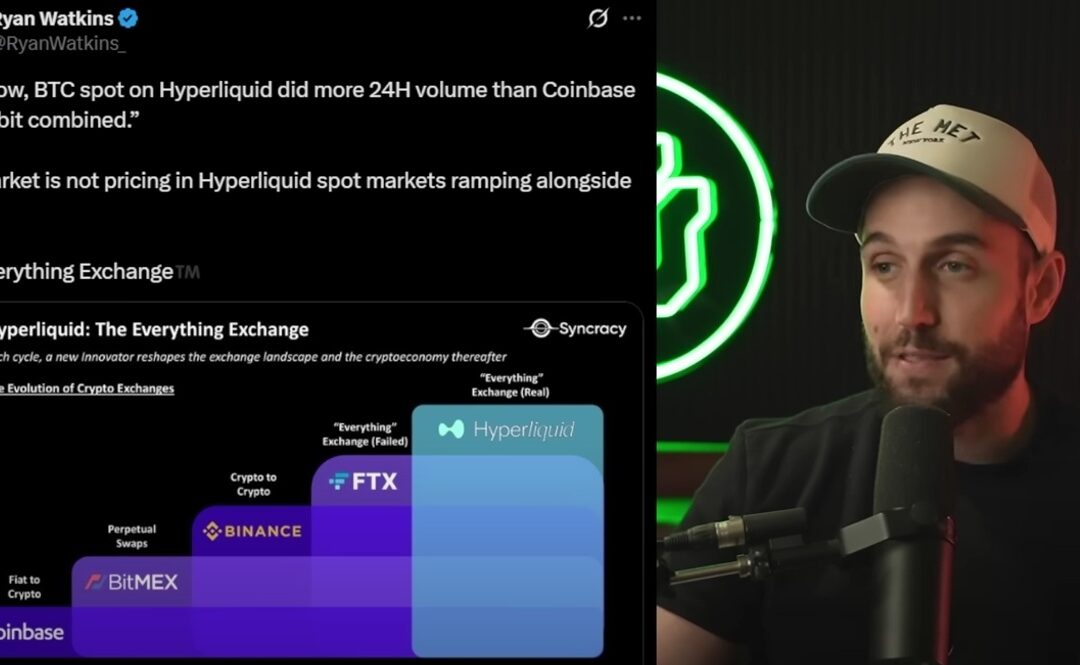

If history rhymes, this dip is an opportunity. Bitcoin may stumble, but altcoins like Ethereum, Solana, Chainlink, and BNB are set to capture liquidity once confidence returns. Projects tied to on-chain market infrastructure — like Hyperliquid, which recently saw more spot trading volume than Coinbase and Bybit combined — are particularly interesting.

Personally, I’m staying invested. I’m not giving up my ticket to this ride. If you missed entries on the way up, this September washout could be your shot.

Conclusion: The Final Dip Before Liftoff?

Call it what you want — a crash, a flush, or just September doing its thing. But if past cycles are any guide, this correction may be the last big chance to position before the final explosive phase of the bull run.

My base case:

-

Bitcoin: recovers toward $140K–$160K into year-end.

-

Ethereum: surges above $7K, with potential to hit $8K–$12K if momentum builds.

-

Altcoins: see liquidity rotation as institutions expand beyond BTC and ETH.

The mission is simple: survive September. Because the real fireworks could come in October and November.

Crypto Rich ($RICH) CA: GfTtq35nXTBkKLrt1o6JtrN5gxxtzCeNqQpAFG7JiBq2

CryptoRich.io is a hub for bold crypto insights, high-conviction altcoin picks, and market-defying trading strategies – built for traders who don’t just ride the wave, but create it. It’s where meme culture meets smart money.