Bitcoin Pullback or Cycle Top? Why This Market Dip Looks Normal

Welcome back, everyone. The crypto market is once again filled with fear after a 10% pullback, but zooming out tells a very different story. While corrections never feel good, they are a normal and healthy part of every bull market. Today, let’s break down why Bitcoin is still structurally strong, the key levels to watch, what this means for Ethereum and Solana, and how macro conditions like rate cuts and liquidity will shape the months ahead.

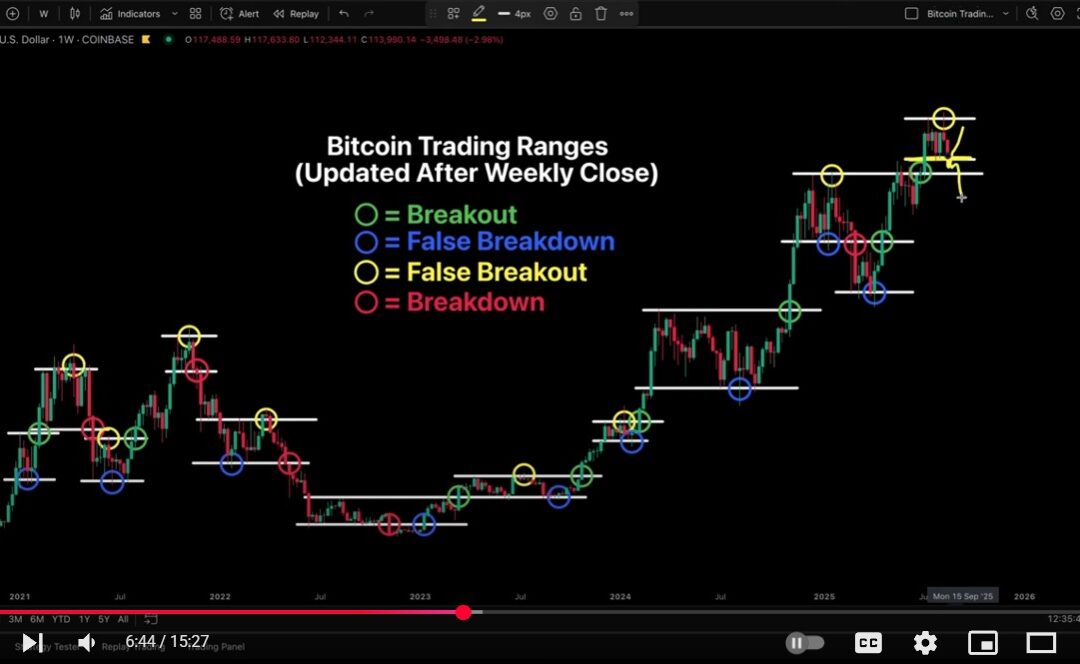

📉 Bitcoin’s Support Levels: The Bigger Picture

Despite the panic, Bitcoin is still above all major support levels:

-

20-week moving average (~$110K) – historically a strong correction target, now lining up with the previous cycle high.

-

50-week moving average – the true line in the sand for whether Bitcoin remains in a bull market.

Throughout this cycle, the 50W MA saved Bitcoin multiple times:

-

April 2025 tariff drama

-

August 2024 yen carry trade chaos

-

September 2023 SEC crackdown on exchanges

As long as Bitcoin holds these levels, the macro bull market is intact.

⚖️ Rising Wedge Fear: Overblown?

Yes, there’s a rising wedge pattern targeting the $85K–$90K range if it breaks down. But patterns like these are not reliable enough to base major investment decisions on. They’re useful for short-term trades—not for selling your portfolio.

Every cycle has bearish narratives, and right now, this wedge is the one dominating headlines. But the stronger case lies with fundamentals and support levels.

🔁 Déjà Vu: Too Similar to 2021

The current cycle looks eerily similar to 2021, with short-term corrections sparking “cycle top” fears. Historically, once everyone piles into a fractal comparison, price action tends to break the pattern and surprise traders.

That’s why my base case is:

-

Bitcoin holds the 20W + prior high ($110K zone).

-

We get another leg higher into September.

-

A deeper reset to the 50W MA is possible but not my primary expectation.

🧠 Market Sentiment: Neutral, Not Euphoric

If this really were the cycle top, we’d expect to see extreme greed, froth, and euphoria. Instead, sentiment has been remarkably neutral—even as Bitcoin hit $124K.

Retail swings wildly from 200K predictions one week to doom and gloom the next after a 10% pullback. That isn’t how cycle tops form. True tops come with excessive greed, not mixed emotions.

📊 ETFs, Institutions & Strategy

Bitcoin ETFs have seen outflows, but nothing compared to the huge inflows earlier this year. It looks more like mild profit-taking than a warning sign.

What is worth noting: MicroStrategy’s buying pace has slowed. Their share issuance strategy means they likely won’t be aggressively stacking BTC unless MSTR trades well above NAV. Historically, MSTR stock failing to make new highs while Bitcoin rallies has been an early red flag. This is something to watch closely.

🔥 Ethereum: Quietly the Strongest Asset

Ethereum just logged its highest weekly close in 4 years and is backed by nearly $3.75B in ETF inflows. Despite fears, ETH looks set for:

-

A retest of $4,000 (aligned with a CME gap).

-

A breakout into price discovery afterward.

-

Continued strength as Ethereum treasuries like BitMine accumulate billions in ETH.

The ETH/BTC pair is still in an uptrend, with a key target around 0.05 BTC.

🌊 Solana & Altcoin Season

Solana remains resilient, holding its upward channel and building anticipation for ETF approvals later this year. But altcoin enthusiasm has cooled—Google searches for “alt season” dropped 50% in one week.

This is typical: retail leaves when prices dip and returns during rallies. The long-term structure for Solana remains bullish.

🌍 Macro: Liquidity Still King

-

Global Liquidity Index will dictate the next leg of Bitcoin’s cycle.

-

The Fed is expected to cut rates in September and October, but maybe not enough to fuel the “easing supercycle” markets want.

-

GDP forecasts remain positive, but inflation is sticky at 2.8%.

-

Massive U.S. deficits and exponential debt growth mean long-term currency debasement, which favors Bitcoin and other scarce assets.

✅ Final Thoughts

-

Bitcoin is still in a bull market. Support levels are intact.

-

Corrections are normal and often give the market more fuel to push higher.

-

Sentiment is not euphoric—which means the top is likely not in.

-

Ethereum is leading, Solana is holding, and altcoin enthusiasm will return once Bitcoin stabilizes.

-

Macro liquidity trends remain the biggest driver to watch.

Corrections like this are where conviction is tested. Zoom out, keep your strategy consistent, and remember: bull markets end in greed, not in fear.

Crypto Rich ($RICH) CA: GfTtq35nXTBkKLrt1o6JtrN5gxxtzCeNqQpAFG7JiBq2

CryptoRich.io is a hub for bold crypto insights, high-conviction altcoin picks, and market-defying trading strategies – built for traders who don’t just ride the wave, but create it. It’s where meme culture meets smart money.